We are big believers that market sentiment is a key driver of price over intermediate cycles and this rally since the Oct bottom has been met with some of the most negative sentiment we can recall in recent memory. Our theory about the inverted risk-on/off trade is predicated on this extreme negativity and as we’ve said one of the biggest mistakes investors are making is in a misinterpretation of risk appetite.

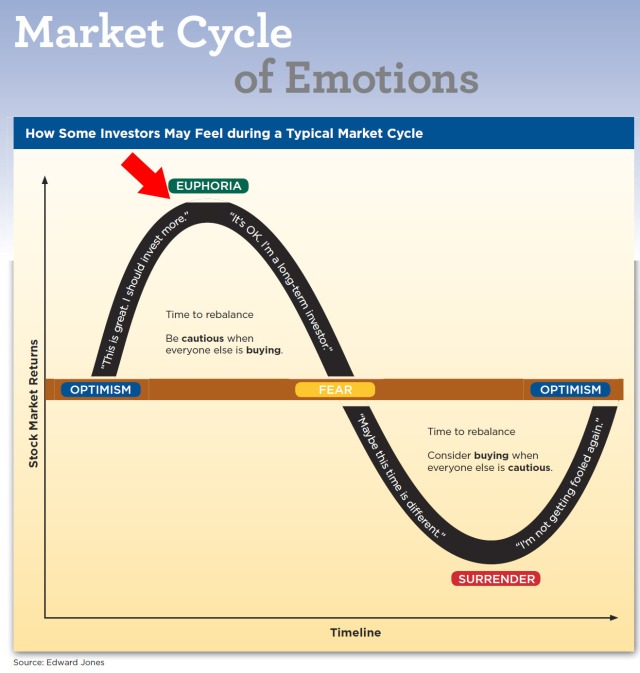

This weekend a friend emailed this chart from Edward Jones that charted the “Market Cycle of Emotions” with an arrow pointing to the top of the “Euphoria” stage. My response was, their arrow is in the wrong place.. more like coming out of surrender and into optimism.

although that might even be a stretch. It’s remarkable how intense the bearishness is out there with the $SPX trading at new highs. We think part of what’s going on is that the 2008 financial crisis was such an obvious short of a lifetime (in hindsight) that made legends out of a few but fools out of the many who missed it. We like to call it “short-sellers remorse”. Every time the market rallies to highs or gets to an extreme the shorts are pounding the table that this is the next big puke. How can the market be in the Euphoric stage if the consensus is trying to short every top tick?

In mapping sentiment we find it helpful to look at the cycle of emotion and apply some market psychoanalysis to the situation. The Five Stages of Grief that describes those who face death can also be applied to investors. Typically these stages are indicative of the end of a bear market.

Denial: “we can’t go down much further”

Anger: “I bought too soon – damn you CNBC”

Bargaining: “if I’m in it for the long run these are good prices”

Depression: “this market will never go back up”

Acceptance: “I’m out”

Since the rally off the Oct lows we see the inverse occurring especially from a short-sellers perspective.

Denial: “this rally is a head fake”

Anger: “this market is so stupid”

Bargaining: “I’ll cover on the next big pullback”

Depression: “this market is never going back down”

Acceptance: “I’m flat”

but what stage are we in? We think we are getting close to Acceptance by the shorts as the short-lived trip to 1340 support that propelled us to new highs is seen as the pullback that no on covered and now they are chasing to get flat. We are cautious up here for a variety of reasons but recognize that this leg of the rally is merely about getting the book more balanced and we aren’t even close to bringing in the real money longs who are largely still in the bond market.

When the shorts finally get flat this market is going to drop and its probably going to drop hard. There is likely a great risk/reward short opportunity soon but keep in mind a wise old man once told me, “there will be no bears left when this market tops.” It feels like there are still a lot bears trying to win the top tick trophy.